Keep in mind that investing will involve danger. The worth of the expense will fluctuate eventually, and you could possibly attain or get rid of money.

To ask for a withdrawal from the account on the net (the speediest way), click on the inexperienced Look at Your Accounts button and register. Then choose the account number for the suitable beneficiary. Click on the inexperienced Withdrawals button at the bottom of your web site.

If you have money remaining around inside of a 529 approach—As an example, In the event the beneficiary gets a considerable scholarship or decides not to go to school in any respect—you'll have a number of solutions.

Using this surge along with the resuming of student loan payments this thirty day period, it’s no surprise family members are searching intently at their 529 programs.

This payment may have an effect on the method through which selected products and solutions or solutions could be displayed all through our Web site. Please note that not all economical service products or services can be found via this Site.

Some, like a adjust while in the age when savers ought to acquire distributions from retirement accounts along with a rule enabling organizations to supply incentives to staff to lead to office strategies, took influence this yr.

Though there are actually Gains to opening a 529 system to avoid wasting for faculty or other training, these plans even have possible shortcomings. Contemplate the two the advantages and disadvantages when selecting the correct go for All your family members.

NC 529 Accounts can be used to speculate for your child, your grandchild, your self, or every other future university student. Contributions to an NC 529 Account and earnings thereon may be used for any myriad of Competent Education Fees. For individuals who are considering opening an Account:

There are various Gains to your NC 529 System. By way of example, Coverdell Schooling Personal savings contributions are limited to $two,000 a year right up until the kid reaches age 18. With all the NC 529 Approach, most allowable contributions usually are not constrained by yr but by overall Account balance for each Beneficiary - which means It can save you approximately you need every year (issue to applicable present tax) until finally total money with the Beneficiary get to the most complete allowable.

For over twenty five many years, Virginia529 has aided millions of family members plan and preserve for upcoming training charges via its tax-advantaged 529 discounts programs. No matter if you're preserving for greater education and learning expenses, K-12 tuition at private and religious universities, university student loan repayment or registered apprenticeship applications, learn how Virginia529 can assist you put together for the longer term.

" Even so, Considering that the new law lets a rollover only for the 529 beneficiary's Roth IRA -- most likely your child's, not yours -- it however is smart to prioritize saving for your very own retirement around saving on your Young ones' school.

Even now, even though each and every point out offers a approach, they aren't all the same. The most beneficial 529 strategies demand the lowest expenses and provide an even better choice of financial commitment alternatives.

There are no federal tax breaks when you set revenue in a very 529 prepare. Even so, that money grows more info tax-free of charge, and there’s no federal earnings tax when you withdraw resources from a 529 strategy if The cash is utilized for certified expenses.

But what if income withdrawn from the 529 plan isn’t used for experienced fees? Not only will You must shell out federal money taxes on These money (And perhaps condition taxes too), but you’ll also be strike with yet another ten% penalty. Ouch!

Devin Ratray Then & Now!

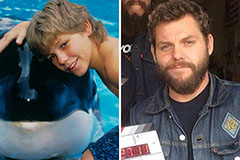

Devin Ratray Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!